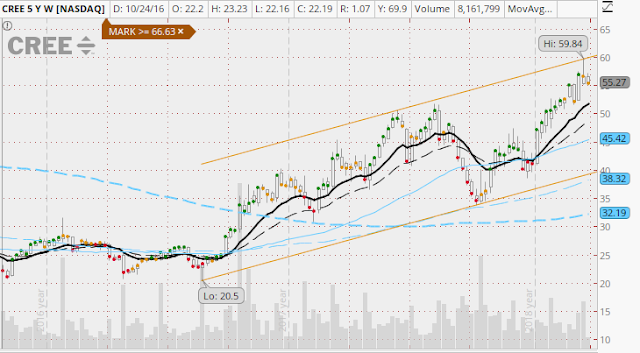

1. Cree Inc. CREE, $55.27

Technical analysis is a great weapon for traders when charts are well developed. CREE, as you know, one of my favorite stocks since mid-2018, is likely in a technical correction. The 2-year uptrend channel in its weekly chart, show the stock touching the upper line, and beginning a pullback probably towards the "value zone" (black lines). MACD and Stochastic (not shown) confirm some exhaustion of the rally. And also the Elder's Impulse System changes from green to yellow in the two last candles indicate a pause in the bullish phase. Friday 22th, during the market sell-off, I closed my position and wait for a further long entry, because the stock maintains its good fundamentals, and this good company has road for growth in the long-term.

2. Cognizant Technology Corp. CTSH, $71.09

Since January I'm following this stock in my watchlist, due to its low valuation with nice numbers in growth and earnings in 2018. After a great initial month and with an Earnings Report beating the market, the CTSH stock couldn't overcome its SMA200 average and entered in a consolidating period that stills two months, preparing for a breakout or a breakaway gap that didn't happen yet. As the channel is tight, is difficult to predict in which direction it will explode. Just put in the radar, doing jealous surveillance to its price and volume behavior.

3. Ubiquiti Networks UBNT, $144.20

Since my last post, UBNT soared after Wall Street likes its last Earning Report. The continuation gap moved the stock to $150 levels, an amazing 50% performance YTD. Now an important figure appears in its daily chart, a double-top, a classic technical sign of turn-down in a stock rallying. Also reinforced with a clear MACD bear divergence, that isn't complete, because its EMA13 average (the black line) is still flat. This simple indicator helps me to avoid many false divergences that usually appear in MACD lines and histogram. I'm anxious to confirm this because UBNT corrections are usually very deep, and so, a good opportunity for shorting it.

4. US Steel Corp. X, $19.22

A good company that is directly suffering the effects of the Trade War, since its beginnings in early 2018. The stock fall is heavy, near 60% from its peak, breaking all main simple averages and Fibonacci retracements. X is the typical stock in which news mainly influence its behavior, and the only great news that will explode this stock toward the stars is a deal US-China: so it's unpredictable, only Trump knows...

I'm watching the $18 level as a good technical entry point, due to its behavior in the last two years when approaches this value. I placed the alert there and I will wait.

Good Trading!

@BravoTrader

{fullWidth}

Tags:

.StocksToWatch