On my Thinkorswim trading platform, I manage several watchlists, differentiating them according to the instruments it contains. There are stocks, futures, ETFs, sectors, and indices watchlists. My different ETFs watchlists usually keep the same symbols in time, diversified by sectors, industries, countries, commodities, both at 1X normal speed and 3X triple speed. My Indices, sectors, and futures watchlists are also fixed, covering the main indexes and commodities from Wall Street and major foreign exchanges, usual symbols well-known by all traders.

Those that do change, usually monthly, are the symbols of my Stock Watchlist, stocks which I follow on a daily basis, due to my own research, that consider both fundamental and technical analysis, news topics, or simply popularity. Over time, it appears in the list new stocks, disappear others, according to the importance they are acquiring, in my opinion.

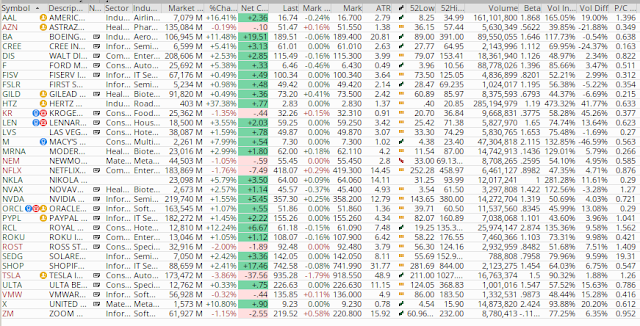

Q3 + Q4 Watchlist

After three months using hardly my "coronavirus strategy" in markets, finally on May 31st. my trading system gave me the technical signal that I can re-open my long portfolio. As usual, I consider ETFs for my long portfolio, and the companies, listed below, just for swing and day trades. Of course, with strong risk management, due to the world economic recession and probable second Coronavirus' wave that could damage more the markets, despite exaggerated Fed stimulus. Some considerations:

- My stock watchlist for the next two months contains my usual-followed stocks from 2019 that get good results as CREE, DIS. FISV, GILD, KR, LEN, LVS, NEM, PYPL, ROKU, ROST, ULTA, and VMW.

- Are include some strong companies from sectors shocked by the coronavirus (airlines, cruises) that are now recovering with many difficulties, like BA, RCL, or X.

- Biotech companies that are in the "vaccine race" are followed these months, just for short-term trades due to its extreme volatility, with names as AZN, MRNA, or NVAX. The play here is speculating on big moves due to its daily news, with long or short trades.

- Of course, popular stocks with big returns YTD, as NEM, NFLX, SHOP, TSLA, ZM are considered these months to take advantage of its momentum. "Trend is your friend" is the best advice for a successful trade.

- Also, I include companies in bankruptcy due to the COVID crisis, that are heavily supported by the Robinhood traders, as AAL, HTZ, or M. These stocks are only for a quick speculative move in a day session: it's irrational that newbie traders, as the mentioned Robinhoods, are pushing high these stocks. The best (and only) play here is short them when they become overbought.

- Keep in mind that my suggestions, charts, and ideas regarding these stocks, in which I'm long, short or neutral, I do in the blog posts. And more fresh data and news posts daily on my Twitter and StockTwits, which are much more friendly and dynamic platforms for a chat and get feedback from traders.

Good Trading!

@BravoTrader

{fullWidth}

Tags:

Watchlist