This post exposes briefly the components of a typical Trading Plan that were summarized in the previous post. Please, take into account that in this post (and in the rest of the posts on my blog) I do not intend to explain each term or indicator, simply because that technical info is all over the internet, on good sites such as investopedia.com or tradingview.com, well explain and detailed. I think is enough with the basics, written in a synthetical way, and mainly, how I use or prefer to use those weapons in my daily trading.

1. Emotions Control

2. Personal Goals

Understand that retail trading is like another work or business in which you generate your monthly income. Therefore, set your real goals, in terms of expected rate or earnings, whether monthly or quarterly better. And evaluate regularly so you make necessary adjustments.

It's simple: forget you will be a millionaire in a year and with a Ferrari in your garage like all the stock traders in the movies. Even less paying expensive courses with magic formulas, and info of unknown companies ready to explode... all bullshit. The courses haha... they wanna your money! If they have the formula for success, why do they need to teach courses? Think: the internet gives you all of that and more... for free! All you need is to search cautiously, analyze the info, and follow only reliable traders.

3. Risk Management

Once your working capital and margin account has been defined, you must be clear about how much risk you could accept in each trade or, in other words, the potential losses in the investment.

For example, Alexander Elder's 6% Rule limits the risk in your account as a whole by stating you never expose over 6% of your account equity to the risk of loss. And its Position Size Rule states that you may never risk more than 2% of your account equity on any single trade. As it's only a suggestion, it's highly recommendable to not overcome those limits. Protect your account!

You establish your preferred risk in every trade through the position of your always present stop-loss (the best friend of a cautious trader), which defines your position size, risk/reward ratio, and maximum drawdown. Remember: as important as the entry (or more) is the exit.

You establish your preferred risk in every trade through the position of your always present stop-loss (the best friend of a cautious trader), which defines your position size, risk/reward ratio, and maximum drawdown. Remember: as important as the entry (or more) is the exit.

4. Choose a specific Instrument, Conditions, and Type of Trading

For a successful trading plan, you need to decide, after trying them, which market instrument you feel more comfortable with. They are many in the US: Equity (stocks, ETFs), Options, Futures, Forex, Penny Stocks, Cryptocurrencies. Generally, you stay in the place where you obtained the best results over time. In my case, I just trade equities and options spreads, and due to the current market environment, now I'm focusing on specific industries and sectors, operating them cautiously in day/swing trades. And, of course, I usually (not in this bearish 2022H1) maintain a long-term US ETF-based portfolio plus some reliable stocks, repositioning and hedging them every month finishes, protecting them from any market correction.

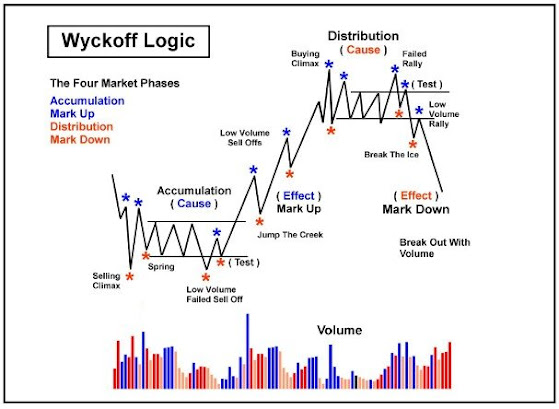

Then establish the market conditions you prefer for trading. The markets are always trending or ranging, no more, generating in its price action, only four typical trades (and traders), and no more, according to Wyckoff's classic theory (check the chart, below).

1- Trend Continuation: those traders who buy at pullbacks on clear or strong rallies, the trend-traders.

2- Trend Termination: traders seeking just for reversals, the contrarian traders that "buy the dips".

3- Support/Resistance Holders: the range traders that trade the range and false breakouts.

4- Support/Resistance Breakout: at end of a range phase, or into it, trades are played by the breakout traders.

In general, there are more types of traders. Let's say "schools" of retail traders: fundamental/technical traders, long/short traders, noise or sentiment traders, option traders, price action/candlestick traders, portfolio/swing/day traders, scalpers, penny and crypto traders, futures and forex traders, quantitative traders... large list! None is better than the other. Just study, try and decide where you feel more comfortable, so focus on it, that`s the only way you could get an edge in your trading. In my case, years doing trading, make me feel more comfortable and safe as a trend trader or breakout trader, in any timeframe.

Finally, consider using a powerful trading platform. For example, Thinkorswim, from the recognized broker Ameritrade, is enough for my trading style. They are many platforms around there, just review its features: market instruments traded, research and charting tools, online support, margin account commissions, etc. And also check opinions about it from reliable traders.

5. Operating style

Once you decide, the ideal is to use a minimum of three timeframes for each case and always review them from top to bottom, since the most important levels (support, resistance, trendlines, and patterns) are obtained from the highest timeframes, and the lowest timeframes are used for the tactical or entry decision.

Another important point is your trading schedule. Decide it according to your time, but remember that novices trade in the opening and pros at the closing hour. In my case, for swing or day-trading, I prefer 3-4 hours after the session begins with market trend and price levels well defined and with volatility usually more "calm". When doing scalping, I prefer just the opposite. And for a long-term position trade, the hour is irrelevant.

Another important point is your trading schedule. Decide it according to your time, but remember that novices trade in the opening and pros at the closing hour. In my case, for swing or day-trading, I prefer 3-4 hours after the session begins with market trend and price levels well defined and with volatility usually more "calm". When doing scalping, I prefer just the opposite. And for a long-term position trade, the hour is irrelevant.

6a. Strategy for Entries and Exits

My trading work consists of searching for equities or ETFs, usually from my watchlist, with a clear market structure formed, that matches my favorite Wyckoff's trades, as I told above: trend trading or breakout trading. If it's difficult to find a recognizable price action inside, I simply avoid it and check the next equity. That's the classic trader's routine. Of course, sometimes I trade reversals and usually avoid ranging trading, due to my risk management.

Entries and exits are probably the most critical decisions for a trader. In my case, although for entries the strategy is unique, for exits it is not.

My entry, for any of the four typical existing trades, will always be decided by the Price Action Analysis and complemented by the moving averages and the RSI indicator. And volume, of course. For me, it's enough: clean and uncomplicated.

- For a trend or breakout trade, I think it's best to ride the trend, trailing the stop-loss and profit-taking on gains, closing part of the position if necessary during the rally.

- For a reversal or range trading I consider capturing the swing move, with a defined risk-reward, that`s a fixed stop-loss and target levels.

Consider that moving average crossovers, Heiken Ashi candlesticks, or technical indicators (such as Parabolic SAR) are useful exit indicators.

6b. Place for Stop-Loss and Target

- Stop-Loss: as mentioned above, I use always a stop-market order slightly below the previous support or above the previous resistance level plus a security gap, as the ATR (the Average True Range, an indicator that estimates the daily volatility of a stock). Or simply place the stop at the most recent swing level, also with the gap. In summary, the stop-loss has to be placed where, if it's triggered, invalidates the initial trading idea. Then I trail the stop-loss only when the recent structure is broken.

Place and trail properly a stop-loss to ride the trend sounds simple, but probably is one of the most crucial decisions, a trader needs to make: requires a lot of emotional control, but the reward can be great.

- Target: align a fixed level according to your default risk-reward number (usually RR=1 for a conservative trade, greater than 3 for an aggressive position). As told before, you decide if maintain the level or move it, trailing the stop on gains.

Again, notice that I always consider that the price action interpretation decides my order execution, the entry, and never a technical indicator signal. This is probably the most important lesson from this entire post and the cause of most of my newbie mistakes: rely too much on entries based on technical indicators and not on price.

The last part of a successful strategy is done after the closing bell: record all your trades, the open and close chart, and all the details of the trade, better in an excel spreadsheet, and learn from your errors.

7. Trading Tools

About technical indicators, the fewer, the better. Keep charts simple and clean, so you focus on the most important data: the price. In my trading work, essential indicators in every timeframe chart are: volume, a trending one as the moving averages (SMA50, SMA200, and EMA50), and an oscillator like the RSI for overbought/oversold levels. Add the VWAP and Volume Profile for day trading and scalping. It's enough: the rest is all Price Action Analysis on predetermined key levels.

Finally, a great tool: Twitter. Renowned traders and smart guys on technical analysis share there (for free) their trading ideas, charts, market and macro views, insights, and more. You don't need any news subscription service, because these amazing traders use them and filter out what needs to be known. The idea is to create your own "financial twitter" (Fintwit) with intelligence: just follow a few reliable traders, review if their posts match with your plan, avoiding the pump-dumpers that are the majority in this trading world. Avoid the harmful "noise" (that's the reason I left Stocktwits).

To complement your Fintwit timeline, add a real-time calendar of economic events (such as the ones on econoday.com or investing.com), for your macroeconomic analysis. In summary, being minimalist in your trading tools is my best advice. Too many rules in your strategy cause fatigue and the common "analysis paralysis".

Good trading,

@BravoTrader

{fullWidth}