In a previous post, we saw how Wyckoff determined that there were four market phases and only four typical possible trades, being the first the Trend Continuation or Trend Trading, which I will discuss in this post. This trading is used by the trend traders, the ones who are followers of the old adage "the trend is your friend", whose strategy is to ride the up or downtrends, usually buying on the price pullbacks, and sometimes in its breakouts, as we will see.

Successful trend traders only focus on trading the trend direction, convinced that the price is never "too high" or "too low", as a price rally can break many resistances until finally reverses. They don't think about "where the price should be going": just trusted in the price action and confirmations to tell what to do.

They prefer trend to reversal trading because they know that swimming against the current is more difficult than just following it, being able to achieve safer entries and better stop-loss places and then an adequate risk-reward, based on the amplitude that rallies usually have, whether they are bullish or bearish, versus the difficulty of achieving an accurate price reversal.

Explaining briefly the main terms

- In an ideal uptrend, prices make higher highs and higher lows (HH-HL structure).

- In an ideal downtrend, prices make lower highs and lower lows (LH-LL structure).

- A breakout is a potential trading opportunity that occurs when an asset's price moves above a defined resistance level or moves below a defined support level on increasing volume.

- A breakout is a potential trading opportunity that occurs when an asset's price moves above a defined resistance level or moves below a defined support level on increasing volume.

- A pullback is a pause or moderate drop in a stock pricing chart from recent peaks that occur within a continuing uptrend. The trend trader takes advantage of those price movements to buy the dips or sell the rallies.

- The trendlines deserve a separate paragraph.

- The key level is a level (more exactly an area) of high confluence that is eyed by different schools and types of technical analysis traders for taking action (schools like support/resistance, trend/reversal, trendline, price action/candlestick, moving averages, divergence, Fibonacci, and even confluence traders). As many schools of traders are analyzing the same trading area, increases the chance of the trade going in your favor.

Never force a trendline drawing!

The trendlines are important pieces of any trend trading strategy. A trendline connects swing highs or swing lows during a trending market and can act as support in an uptrend or resistance in a downtrend. Also, a break of it can signal a trend change. Trend traders buy rising trendlines (and sell the falling ones) usually buying when the price touches the trendline.

Its drawing becomes of decisive importance for the trend trader (and for all the other types of traders!). Take note of the following concepts for a better drawing:

- Need a minimum of three swing touches, never two! The more touches, the better. Remember to contain swing highs and lows inside the trendline, without forcing it (a recurrent and erroneous practice that we have all had when novices and that has been the cause of many bad trades).

- Select the more obvious trendlines, and treat them as "zones" like with S/R levels. Remember always that they are just a guide for your analysis, not a law.

- In a moving trend, not always you can draw a trendline (no swing highs and lows). Trends, like the market, are choppy, never smooth as desired.

- Draw your trendline in an area where you get more touches, no matter body or wick ends.

- Select the more obvious trendlines, and treat them as "zones" like with S/R levels. Remember always that they are just a guide for your analysis, not a law.

- In a moving trend, not always you can draw a trendline (no swing highs and lows). Trends, like the market, are choppy, never smooth as desired.

- Draw your trendline in an area where you get more touches, no matter body or wick ends.

As usual, price action analysis work on key levels. And here, the key levels are located where a trendline crosses an S/R level, usually from your higher timeframe.

|

A typical structure, taken again from forex.doc (great charts there!): uptrend (HH-HL) and downtrend (LH-LL), showing its swings, support, and resistance levels. Trend trading basically consists in ride the trend through correct entry levels and stop-loss place, at a key level. Add moving averages, and you have the basic tools for a successful trade. Be simple, practice a lot. |

Then, how a continuation trend works?

As told before, it's highly recommendable to analyze this price action in at least two timeframes. In the higher, to define the trend, the S/R or key level, and finally, decide or not to trade. In the lower, the operative, you can see immediate trendlines, and candlestick patterns with more detail, and evaluate the mentioned rejection at the key level.

Just as the " buy the dip" was a profitable strategy for last year's bull market, for 2022H1 it is clear that the "sell high" (as the example below) would be the right strategy for the bear market that is coming. Both are cases of trend trading.

|

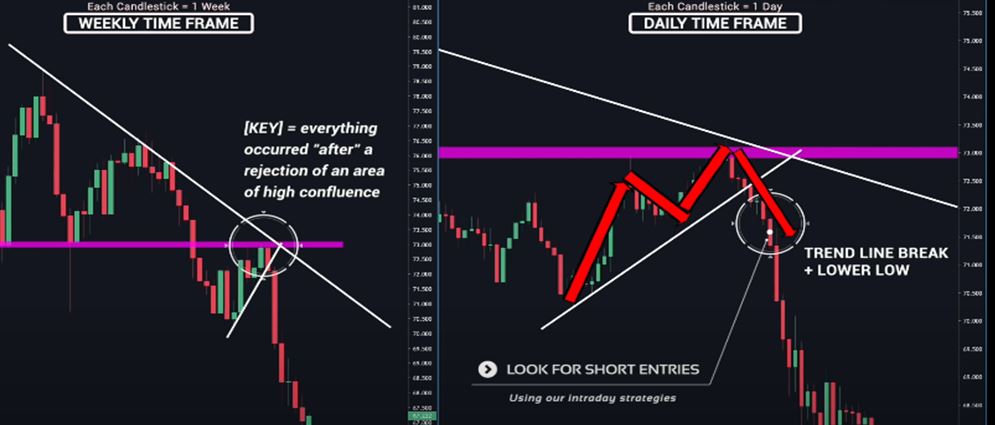

Check the following downtrend continuation in this chart in two timeframes, weekly and daily, taken from wysetrade.com, a recommendable site! In the higher timeframe, check when the price approaches the level where the downtrend line crosses the support level (in a circle) and wait there for a price rejection through a candlestick pattern, such as pin-bar, Harami, or Doji. Go then to the (lower) daily timeframe. In order to enter after a rejection, draw a trendline (bullish in this case) under the immediate moving trend and wait for a breakdown of this for an entry trade. The big-picture trend (bearish) is confirmed. only after the next candlestick confirmation candle: the bigger, the better. |

Entries and Exits

That would be the basic scheme of how a continuation is generated. Now, in a practical way, for an entry, I usually execute a typical rule using Price Action Analysis: in the higher timeframe search for a stock on a strong or healthy trend and wait until it weakens. Then check a (multiple) price rejection (pin-bar, harami) formed after price touches a key level in its pullback. Analyze then the lower timeframe and wait for the price breaks an immediate trendline (or retest a key level), and then a confirmation through a momentum candle, that will be the signal for buying that dip.

Of course, there are many variations of the rule, according to each trader. For example, other traders use moving averages or the Fibonacci 61.8% of the last swing as a filter to recognize if the pullback is valid or if it's a trend-change in price. The idea is the same: buyers are taking a breath there with enough force to continue its uptrend, or not.

In any case, to exit a trade in trend trading, I manage my risk/reward by trailing the stop loss to a structure or a recent support/resistance level. And if get an important rally I always consider taking a percentage of the gains during it. And take note: technical indicators (such as moving averages crossovers, Heiken Ashi candlesticks, or the popular Parabolic SAR) don't give reliable levels for entries but yes for exits

Importance of Moving Averages in Trend Trading

The moving averages are a form of dynamic support-resistance level, due to their change over time. And in trend trading, the same as S/R levels or trendlines, traders look for the rebounds in them.

It's nearly mandatory to have a long and a short simple moving average in a daily chart. Traders use the DMA50 and DMA200 simply because are the most popular, and traders, especially smart money and the big guys, use them in their decisions. No need to discover another fantastic one. I always use them and add one, quicker, the simple moving average 20 (DMA20). These three averages allow classify the trend trading due to its rebounds in these dynamic lines:

- Strong: show shallow pullbacks, with the price rebounding on the DMA20, with its max-retracements below the Fibonacci 38.2% level of its recent swing. Traders usually ride the trend here, buying the breakout of the swing high, and moving the stop-loss.

- Healthy: show obvious pullbacks, with the price rebounding on the DMA50, with its max-retracements below the Fibonacci 50% level. The trade here is to buy the pullback on dma50.

- Weak: the trend has deep pullbacks, with price supports on the DMA200, with its max-retracements at the Fibonacci 61.8% level. Risky traders buy here the pullback on DMA200 and prefer to capture the swing move with a fixed stop-loss adequately placed.

In general, is better to avoid trading the trend direction when the price is far from the moving average or a structure swing (allows the use of a tight stop-loss), or when the price overcomes the Fibonacci 61.8% of the last swing: that pullback could be a trend-change in price. More conservative traders use Fibonacci 38.2% as a filter.

That's the way to gauge a trend by using moving averages. The more "indicators-oriented" traders prefer to use the Average Directional Index ADX indicator to determine the strength of a trend using their higher or lower readings. For me, not necessary, but is perfectly valid.

Applying the theory

As inflation is now one of the market drivers, since 2021 I'm following, and trading for the mid-term, $DBC an ETF that tracks futures of diverse commodities like oil, gas, metals as well as corn, wheat, and sugar, elements that historically benefits from it.

In the daily chart, above, I use my typical moving averages DMA20 (green), DMA50 (tight light blue), and DMA200 (wide light blue). And the RSI as an oscillator. That's enough for me for a Price Action Analysis.

Despite being a very simple theory, trend trading takes time to dominate as is not just drawing well charts and lines: it's mostly about risk management and psychology (patience, emotional intelligence, discipline...). Finally, doing well provides great rewards.

Good trading,

@BravoTrader

{fullWidth}