|

Along with Trend Trading, one of the most exciting moves loved by all traders, novice or professional, is to determine a precise breakout, via the so-called Breakout Trading. In my case, they are my two favorite trades out of the four defined by Wyckoff, because I see them as somewhat less risky than the other two, Reversal and Range Trading.

A breakout, as is known, is a potential trading opportunity that occurs when an asset's price moves above a defined resistance level or moves below a defined support level on increasing volume. And Breakout Trading uses technical analysis to identify high-conviction breakout patterns that can profit from bullish rallies or bearish downtrends. As explained in recent posts, use mainly Price Action Analysis on accurate timeframes, with candlesticks and price patterns (and a few technical indicators), to find breakouts that happen at key support and resistance levels.

And just as there are breakouts, there are false breakouts and whipsaws. All traders (day, swings, position) are exposed to them. Markets have many false breakouts below support and above resistance, every day, with prices returning to their previous "range zone" after a brief violation.

On the other hand, the whipsaws happen when a sharp price movement is quickly followed by a sharp reversal, all inside a common support or resistance line. Just after the probable breakout, we could identify another "range zone", a zone of conflicting interests where price oscillates between two boundaries. A range "danger zone" for a conservative trader, exciting for the risky ones.

In summary, a breakout generates, first, traders who want it to occur and make decisions in that direction. Others expect the range zone to continue, fading the breakout. And, finally, are those contrarian traders who are waiting for the momentum to wane and immediately trade back in the other direction. All valid strategies, and profitable, if doing following a careful price action analysis, psychology, and risk management. Let's review briefly these three types of breakout trading.

1. Recognize a Successful Breakout Trade

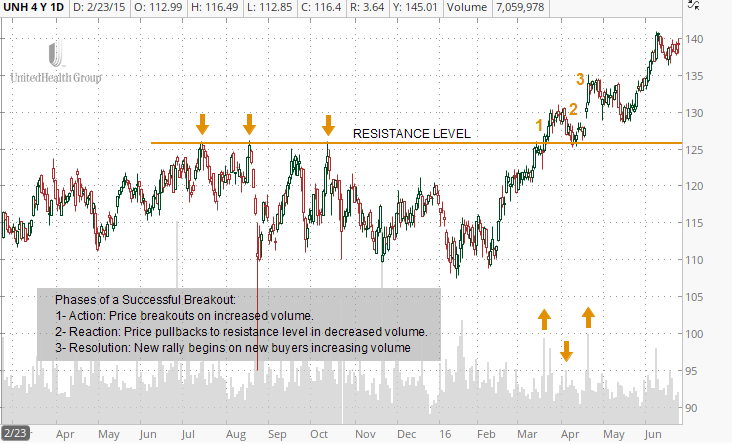

Confirmed breakouts happen every day, but the more powerful and trustworthy were the ones that occur in three phases clearly defined, involving Price Action and volume:

1. Action: price breaks through a resistance (or support) on increased volume. Many inexperienced traders think this move is enough for a sure breakout. Many times it's correct, sometimes could happen the contrary.

2. Reaction: as the price expands some ticks, then the buying interest fades, and the market sell-off creates a pullback. Fresh buyers see the breakout level as the logical point to place their trades. The main characteristic of this reaction phase (or retest) is decreasing volume.

3. Resolution: A new rally begins when it touches the breakout level, with a price above the Action phase high, again with increasing volume. New buyers need to jump in to ensure this resolution phase. If the volume fails in this scheme of three phases, false breakouts and whipsaws are generated.

|

Above, in this daily chart of $UNH, you can see how powerful the $125.50 resistance was: three times could not be overcome between July and November 2016. Only in March 2017 was it able to overcome the level, producing the Action, the first phase of the breakout, with an increase in volume. The Reaction phase is decisive to know which direction the stock will take. It lasted two weeks, after which the price returns to the level of resistance, where the bulls pressed upwards to complete the Resolution stage with increasing volume. Finally, the stock reach to $170 level in December (not seen in the chart), confirming the power of a breakout when it meets all three phases with volume considerations. Just a clear resistance line, Price Action basics, and volume, with no technical indicators. |

This is the basic theory of how a textbook breakout is generated. About the entry or exits, some considerations:

- Is a typical practice to use buy-stop orders above the resistance level, to catch a breakout. This prevents hasty entries, as always is better don't trade exactly at an S/R level, and wait for a resolution.

- Avoid placing the stop-loss at S/R levels, for logical reasons. Better choose zones with little or no traffic.

- As with trend trading, to exit a trade in a successful breakout trading, I trail the stop-loss to a structure or a recent support/resistance level, riding the rally. And if gets really important, I always consider taking a percentage of the gains during it. And take note: technical indicators (such as moving averages crossovers, Heiken Ashi candlesticks, or the popular Parabolic SAR) don't give reliable levels for entries but yes for exits.

Some details I consider when trading breakouts:

- When price breakouts strongly (many price action signals), often a pullback (the reaction phase) didn't occur. Sometimes, in this case, the price is no need to retest to resistance for confirmation, just rally. There are no buyers closing longs or sellers entering short.

- If you want to avoid a false breakout (not a good idea necessarily), trade patiently: wait for the stock volatility to decrease when the price is approaching or at the resistance level, identifying it by their successive small candles in the higher timeframe, checking rejections in the lower timeframe, as entry signals. This means the price is squeezing some days, expecting something big to happen soon. Again, follow the pros that prefer to trade a low-volatility environment on the higher timeframe: need a tight stop-loss, so allow more position size and better risk-reward. Avoid high volatility, is more exciting but riskier.

- Is a typical practice to use buy-stop orders above the resistance level, to catch a breakout. This prevents hasty entries, as always is better don't trade exactly at an S/R level, and wait for a resolution.

- Avoid placing the stop-loss at S/R levels, for logical reasons. Better choose zones with little or no traffic.

- As with trend trading, to exit a trade in a successful breakout trading, I trail the stop-loss to a structure or a recent support/resistance level, riding the rally. And if gets really important, I always consider taking a percentage of the gains during it. And take note: technical indicators (such as moving averages crossovers, Heiken Ashi candlesticks, or the popular Parabolic SAR) don't give reliable levels for entries but yes for exits.

Some details I consider when trading breakouts:

- When price breakouts strongly (many price action signals), often a pullback (the reaction phase) didn't occur. Sometimes, in this case, the price is no need to retest to resistance for confirmation, just rally. There are no buyers closing longs or sellers entering short.

- If you want to avoid a false breakout (not a good idea necessarily), trade patiently: wait for the stock volatility to decrease when the price is approaching or at the resistance level, identifying it by their successive small candles in the higher timeframe, checking rejections in the lower timeframe, as entry signals. This means the price is squeezing some days, expecting something big to happen soon. Again, follow the pros that prefer to trade a low-volatility environment on the higher timeframe: need a tight stop-loss, so allow more position size and better risk-reward. Avoid high volatility, is more exciting but riskier.

2. Taking advantage of False Breakouts: the "Stop Hunting"

Best than avoid the false breakout, the idea for some skilled traders is to recognize when it happens, and take advantage of this. Alexander Elder, in his book "Coming into my Trading Room", considers that some of the best trading opportunities occur after false breakouts, up or downside (at a support level is called false reversals). The patterns, in the higher timeframe, are similar to tails, with only a single wide bar, whereas false breakout can have several bars, none of them especially tall. The rules are easy:

- When the price falls back into the range zone after a false breakout, you have extra confidence to trade short. Use the top of the false breakout as your stop-loss point.

- Once the price rallies back into the range zone after a false reversal, you have extra confidence to trade long. Use the bottom of that false breakout as your stop-loss point.

He explains the dynamics of a false breakout: "after price hits a resistance, the professional traders (the ones who hold your orders) know there are many buy orders above the resistance level, generally of traders looking to buy a new breakout, and others are protective stops of the short-sellers. A false breakout occurs when pros "organize a fishing expedition" to run stops. For example, when a stock is slightly below its resistance at 60, the floor may start loading up on longs near 58.85. As sellers pullback, the market roars above 60, activating the buy stops. The floor starts selling into that rush, unloading longs as prices touch 60.50. When they see that public buy orders are drying up, they sell short with confidence, and prices tank below 60." This professional price manipulation is known as stop hunting and happens every day at every timeframe. The lesson, as I always say: never fight the smart money, just follow them!

- When the price falls back into the range zone after a false breakout, you have extra confidence to trade short. Use the top of the false breakout as your stop-loss point.

- Once the price rallies back into the range zone after a false reversal, you have extra confidence to trade long. Use the bottom of that false breakout as your stop-loss point.

He explains the dynamics of a false breakout: "after price hits a resistance, the professional traders (the ones who hold your orders) know there are many buy orders above the resistance level, generally of traders looking to buy a new breakout, and others are protective stops of the short-sellers. A false breakout occurs when pros "organize a fishing expedition" to run stops. For example, when a stock is slightly below its resistance at 60, the floor may start loading up on longs near 58.85. As sellers pullback, the market roars above 60, activating the buy stops. The floor starts selling into that rush, unloading longs as prices touch 60.50. When they see that public buy orders are drying up, they sell short with confidence, and prices tank below 60." This professional price manipulation is known as stop hunting and happens every day at every timeframe. The lesson, as I always say: never fight the smart money, just follow them!

|

In November 2019, $KO reached a peak at $47.50, then attacked that level in January and rallied above $48.50, only to sink below the old peak a few days later. The false upside breakout (in the yellow circle) marked the end of its bull market. Back experiences said you can short with confidence in the $47 level (big red confirmation candle there) with a stop-loss in $47.50 for a profitable trade. |

Some additional notes:

- At support levels, in the called false reversal, the trap is the same: amateurs went long at the key level without waiting for a candle confirmation. Pros entry selling eating the stop-loss and increasing the bearish candle.

- And finally, consider that false breakout also can occur with massive wicks rejection forms slightly after a breakout, followed by a next inverse momentum (or engulfing) candle crossing the level. Again, is a good opposite trade opportunity.

3. A simple rule for whipsaws: avoid it

The feared whipsaws, the nightmare of all swing traders, emerge when the reaction phase of a breakout, mentioned above, failed. The size of the drop depends on how powerful are the forces that pull prices back to the resistance level, versus how many bulls try to support the market. These two forces decide the price behavior: sometimes the whipsaw fades out and a successful breakout begins immediately. In that instant, the loss of volatility gives a good buying signal, especially for RangeTraders that like this movement.

Good trading,

@BravoTrader

{fullWidth}